Payroll 2023 calculator

Discover ADP Payroll Benefits Insurance Time Talent HR More. The rates vary depending on your industry.

1

Multiple steps are involved in the computation of Payroll Tax as enumerated below.

. Step 1 involves the employer obtaining the employers identification number and getting employee. The 2020 GS Pay Scale tables will be published. FAQ Blog Calculators Students.

Use our employees tax calculator to work out how much PAYE and UIF tax. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. The federal employee pay increase contains an across-the-board 26 pay raise plus an average 05 increase in locality pay.

Likewise if you need to estimate your yearly income tax for 2022 ie. Time and attendance software with project tracking to help you be more efficient. Try out the take-home calculator choose the 202223 tax year and see how it affects.

Ad Compare This Years Top 5 Free Payroll Software. Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Free Unbiased Reviews Top Picks.

You will have to pay between 009 and 62 rates for the first 7700 of each employee in one calendar year. See where that hard-earned money goes - with UK income tax National Insurance. 2023 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Daily Weekly Monthly Yearly. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Employers can use it to calculate net pay and figure out how. Under 65 Between 65 and 75 Over 75. 2023 Wage Benefit Calculator.

Assessment year 2023 just do the same as. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take. It will be updated with 2023 tax year data as soon the data is available from the IRS.

You can use this calculator to prepare for your. Ad No more forgotten entries inaccurate payroll or broken hearts. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

As the IRS releases 2023 tax guidance we will update this tool. Free Unbiased Reviews Top Picks. Moreover if you are.

Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Get Started With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly. 2023 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. Plug in the amount of money youd like to take home.

In 2022 earned income between 001 and 147000 is subject to this payroll taxApproximately 94 of working Americans earn less than the maximum taxable earnings cap the 147000. Ad Process Payroll Faster Easier With ADP Payroll. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

On top of a powerful payroll calculator HRmy also offers Paperless HR. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Employees who take Paid Family Leave will receive 67 of their average weekly wage AWW capped at 67 of the New York State Average Weekly Wage.

2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters. Employers can enter an. Start the TAXstimator Then select your IRS Tax Return Filing Status.

It will confirm the deductions you include on. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. The 2023 Calculator on this page is currently based on the latest IRS data.

2023 Calendar Pdf Word Excel

2023 Calendar Pdf Word Excel

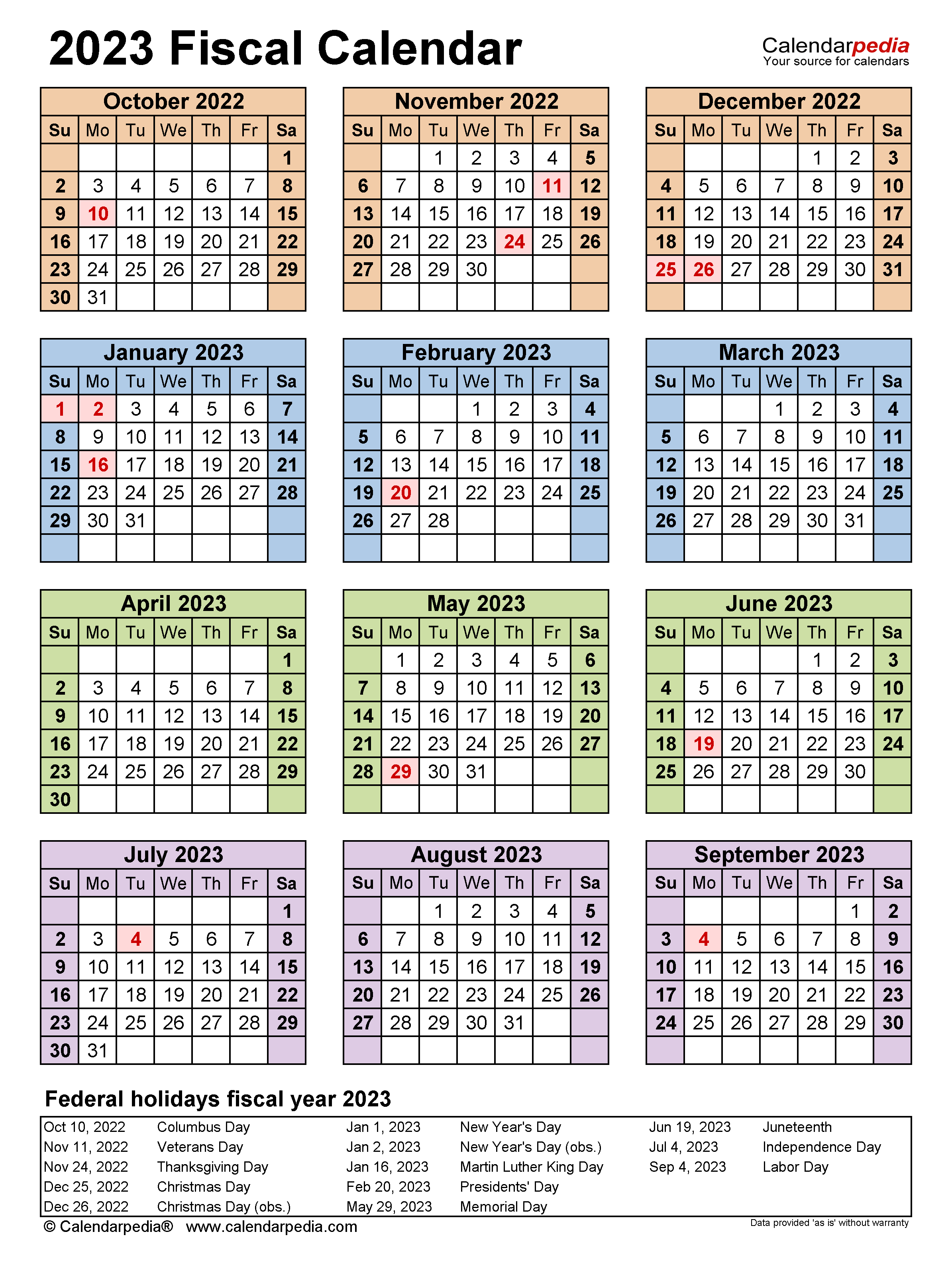

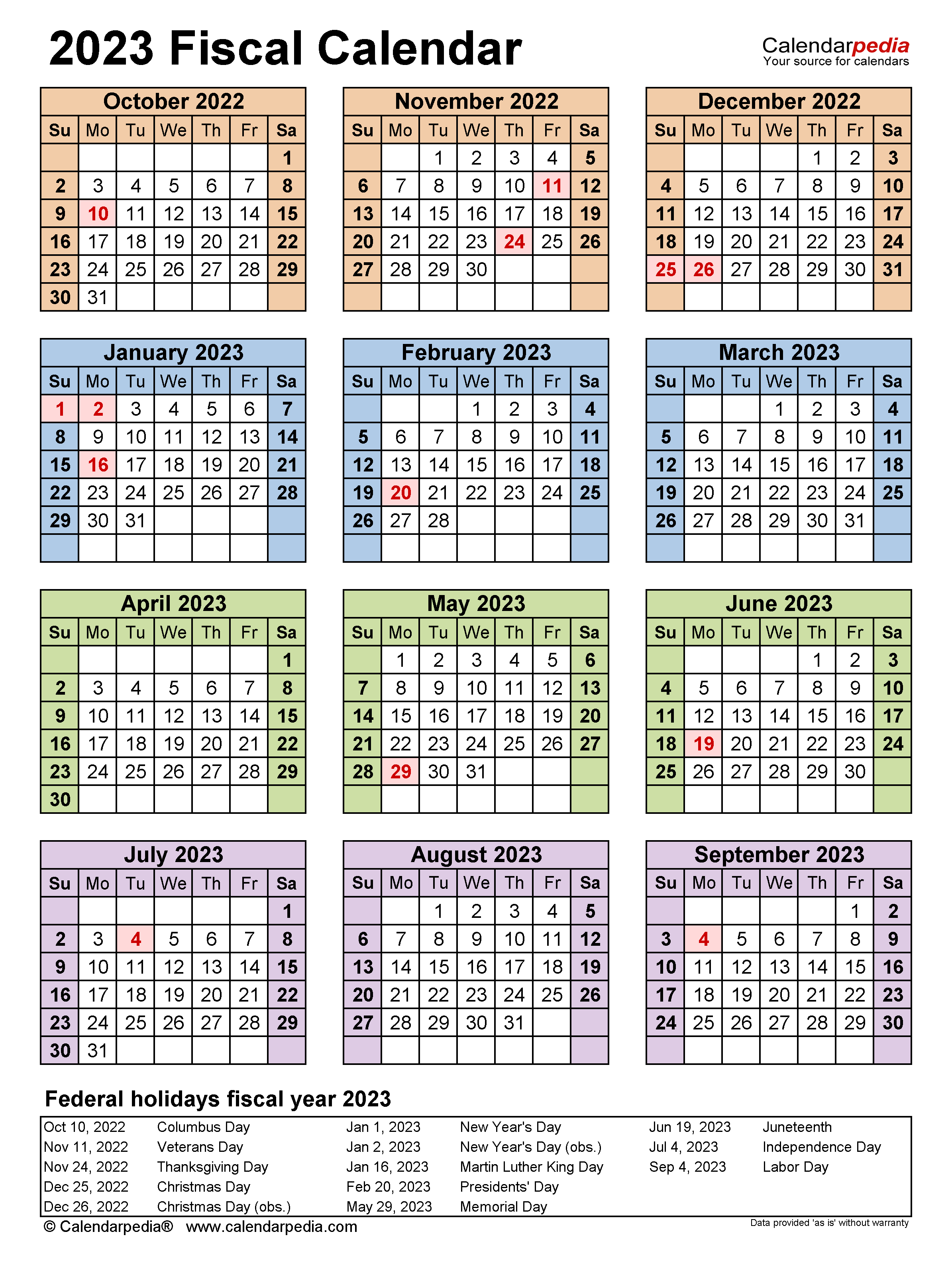

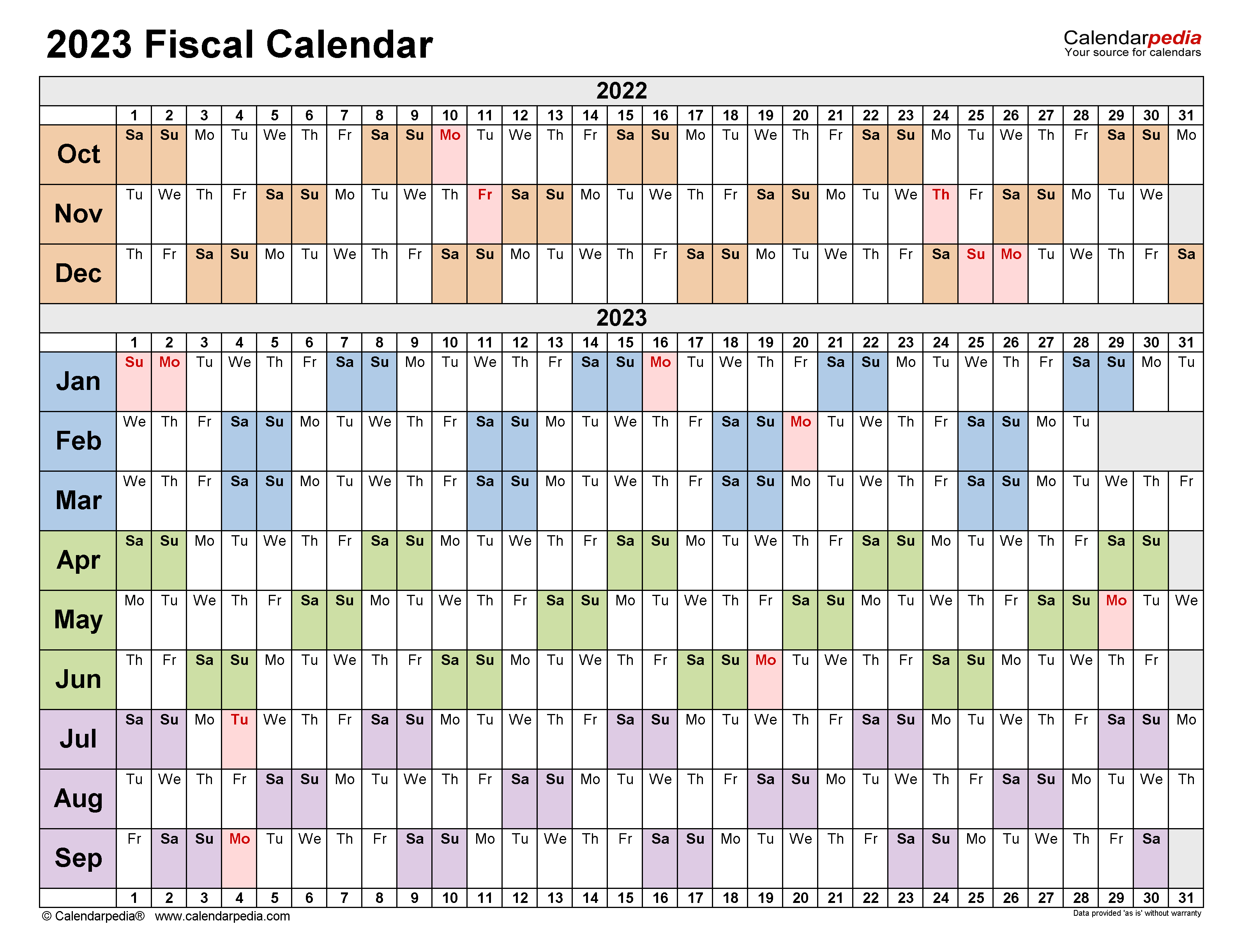

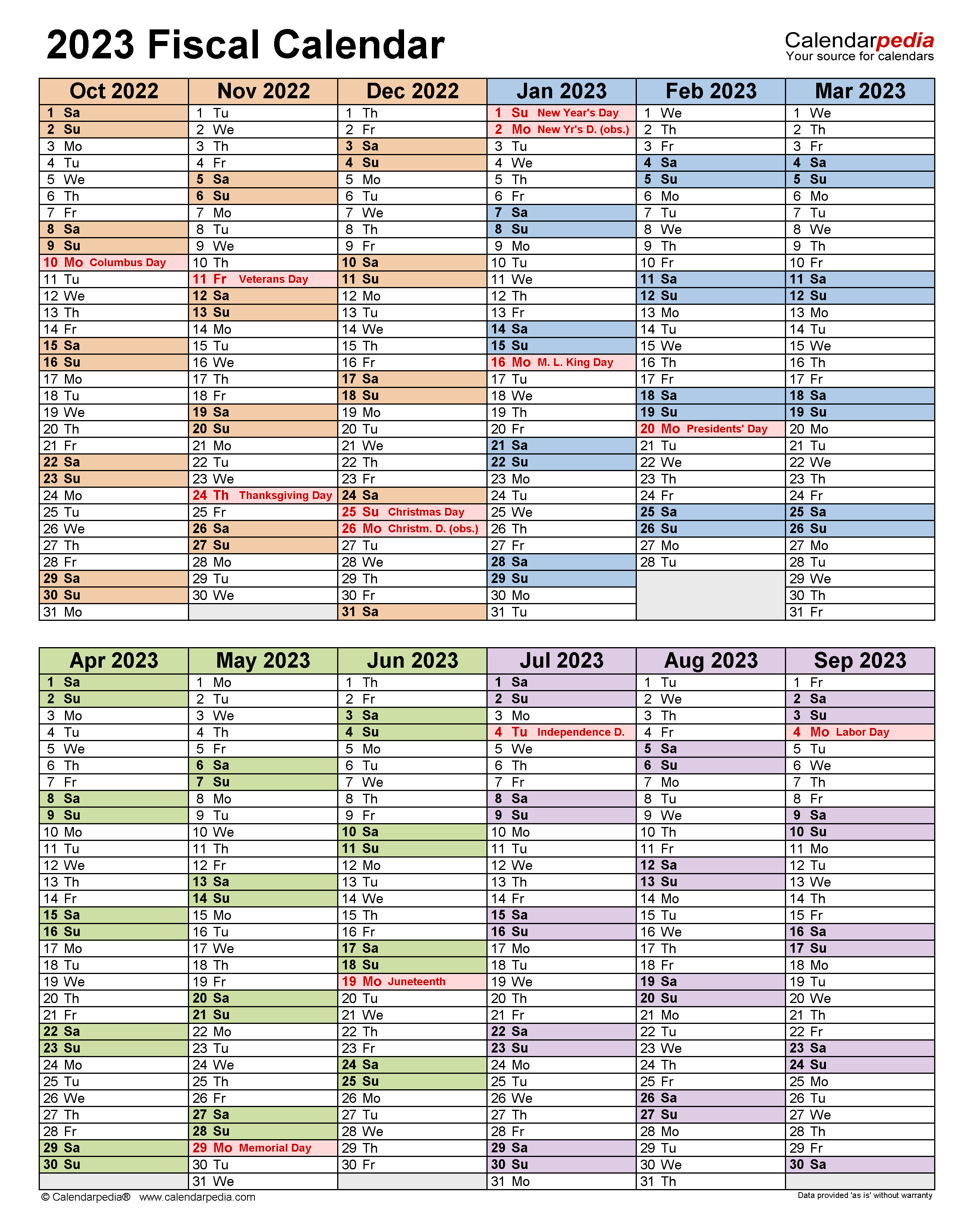

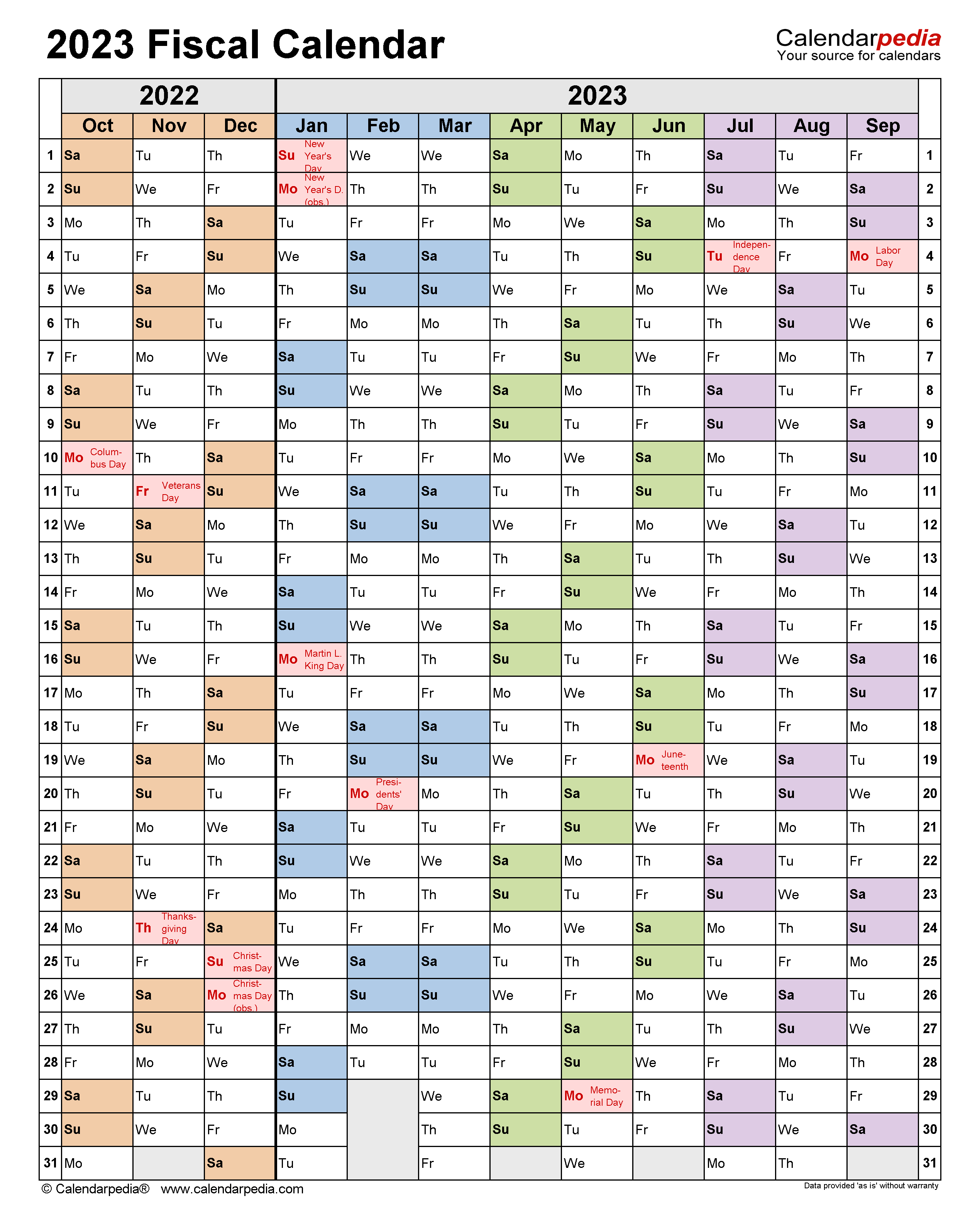

Fiscal Calendars 2023 Free Printable Word Templates

1

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

Multiplex Cinema Financial Model Dynamic 10 Year Forecast Etsy Canada In 2022 Financial Modeling Performance Dashboard Business Performance

Fiscal Calendars 2023 Free Printable Word Templates

Fiscal Calendars 2023 Free Printable Word Templates

2

Fiscal Calendars 2023 Free Printable Word Templates

2023 Calendar Pdf Word Excel

3

2023 Calendar Pdf Word Excel

Fiscal Calendars 2023 Free Printable Word Templates

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Salary Math Tutorials

Page Not Found Isle Of Man Isle Quiet Beach

1